💳 Payment Processing for Small Business: Choosing the Right Solution

💳 Payment Processing for Small Business: Choosing the Right Solution

Your online store is beautifully designed, your products are compelling, and your marketing is driving traffic. But none of that matters if your customers can’t easily and securely pay for their purchases. Choosing the right payment processing solution is one of the most critical decisions for any e-commerce business. In 2025, customers expect seamless, secure, and diverse payment options. Get it wrong, and you risk abandoned carts and lost sales. Get it right, and your checkout becomes a frictionless path to revenue.

This guide will demystify payment processing for small businesses, breaking down the key components, popular options, and crucial factors to consider when making your choice. Whether you’re setting up your first store with a website builder or looking to optimize your existing checkout, understanding payment processing is essential for e-commerce success.

🤔 What is Payment Processing?

Payment processing is the entire system that allows your business to accept online payments from customers and securely transfer those funds into your bank account. It’s a complex behind-the-scenes operation that involves several parties working together to authorize, clear, and settle transactions.

💡 Why Choosing the Right Solution Matters

- Impacts Conversion Rates: A smooth, secure, and familiar checkout experience reduces cart abandonment.

- Affects Your Bottom Line: Fees can eat into your profits. Understanding pricing structures is key.

- Ensures Security: Protecting customer data is paramount. The right processor ensures PCI DSS compliance and fraud prevention.

- Builds Trust: Offering trusted payment methods (like PayPal or Apple Pay) reassures customers.

⚙️ Key Components of Online Payment Processing

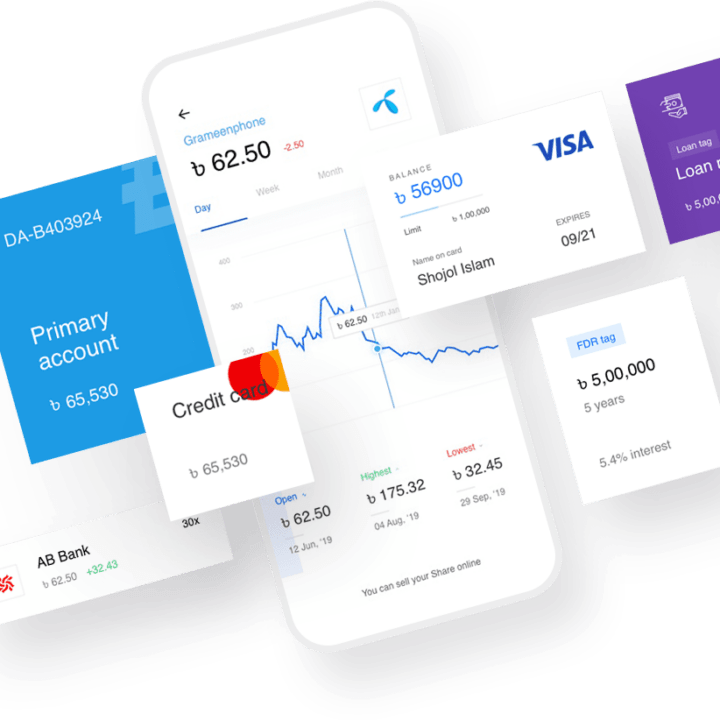

- Payment Gateway: This is the secure connection between your e-commerce store and the payment processor. It encrypts sensitive credit card information and sends it for authorization. (e.g., Stripe, PayPal, Authorize.net).

- Payment Processor: This is the financial institution that actually processes the transaction, communicating with the customer’s bank to authorize or decline the payment.

- Merchant Account: This is a special bank account that temporarily holds the funds from your online sales before they are transferred to your regular business bank account.

💲 Key Payment Options for E-commerce in 2025

- Credit and Debit Cards: Visa, Mastercard, American Express, Discover. Still the most common payment method globally.

- Digital Wallets: Apple Pay, Google Pay, Samsung Pay. These offer a fast, secure, and convenient checkout experience, especially on mobile.

- PayPal: A widely recognized and trusted payment method, especially for international customers.

- Buy Now, Pay Later (BNPL): Services like Klarna, Afterpay, and Affirm allow customers to pay for their purchases in installments. These are growing rapidly and can significantly boost conversion rates.

- Bank Transfers (ACH/SEPA): Direct bank transfers are common for B2B transactions or larger purchases.

- Cryptocurrency: While still niche, accepting Bitcoin or Ethereum is gaining traction for certain businesses and customer segments.

✅ Crucial Factors When Choosing a Provider

- Transaction Fees: Most providers charge a percentage per transaction (e.g., 2.9% + $0.30). Some have monthly fees or charge for chargebacks. Compare these carefully.

- Security and PCI Compliance: Ensure the provider is PCI DSS compliant to protect your customers’ sensitive data and your business from fraud.

- Ease of Integration: How easily does the processor integrate with your e-commerce platform or website builder? Look for plug-and-play solutions.

- Payout Times: How long does it take for funds to be transferred from the merchant account to your business bank account? (Typically 2-7 business days).

- Customer Support: What kind of support do they offer if you encounter issues?

- Global Capabilities: If you plan to sell internationally, can they accept multiple currencies and local payment methods?

⭐ Popular Payment Processors for Small Businesses

- Stripe: Highly popular among developers and businesses of all sizes. Offers robust APIs, global support, and competitive pricing.

- PayPal: Widely recognized and trusted by consumers globally. Easy to integrate, but sometimes has slightly higher fees.

- Square: Excellent for businesses that sell both online and in-person, offering seamless integration between your e-commerce store and physical POS system.

- Shopify Payments: Shopify’s built-in payment processor, offering simplified setup and often lower transaction fees for Shopify store owners.

- Pixel Cloud Media Payments: Integrated directly into our Website Builder, providing a seamless and secure checkout experience for your customers with competitive rates.

📈 Case Studies: Payment Processing Wins

Case Study 1: A Local Clothing Store

A small clothing boutique noticed a high cart abandonment rate on mobile. They integrated Apple Pay and Google Pay into their checkout process. This allowed mobile shoppers to complete their purchases with just a few taps, reducing their mobile cart abandonment rate by 22% and significantly boosting mobile sales.

Case Study 2: An International E-commerce Brand

An online art print store wanted to expand into Europe. They chose a payment processor that supported multi-currency pricing and local payment methods like SEPA Direct Debit. By offering customers the ability to pay in their local currency and with their preferred method, they saw a 40% increase in sales from European markets within six months.

❓ Frequently Asked Questions

Do I need to offer multiple payment options?

Yes, absolutely. Offering a variety of payment methods caters to different customer preferences and can significantly reduce cart abandonment rates. The more options you provide, the more likely a customer is to complete their purchase.

Are payment processing fees negotiable?

For very high-volume businesses, it is sometimes possible to negotiate lower transaction fees directly with payment processors. For most small businesses, the advertised rates are standard, but it’s always worth comparing different providers.

What is PCI DSS compliance?

PCI DSS (Payment Card Industry Data Security Standard) is a set of security standards designed to ensure that all companies that process, store, or transmit credit card information maintain a secure environment. When you use a reputable payment processor, they handle most of the compliance burden for you.

Choosing the right payment processing solution is a foundational step for any successful e-commerce business. It directly impacts customer trust, user experience, and your bottom line. By selecting providers that offer competitive fees, robust security, and seamless integration with your platform, you can create a frictionless checkout experience that maximizes your sales. Set up seamless payments today with Pixel Cloud Media’s Website Builder, ready with integrated payment solutions to power your online store.